It’s all about building relationships and trust and taking the long-term view! We recognise that you will place a lot of trust in iCS when you engage us, so you should stay in control; either as a standalone business if we are engaged directly or in conjunction with your accountant if they introduce us. We will educate you and support you, openly and transparently, to understand how the R&D Tax Credit Scheme works from start to finish, and why we build each claim as we do and then repeat this process annually.

Our highly experienced Technical Consultants have senior level experience covering a wide range of industry sectors. This enables iCS to identify your real innovations and true R&D activities, to best present your case to HMRC. We have an exemplary track record of successful claims, but only after we have conducted scheme compliant checks through a qualifying interview (or two if needed) with you and your technical experts. iCS have advised on hundreds of claims, across all applicable sectors.

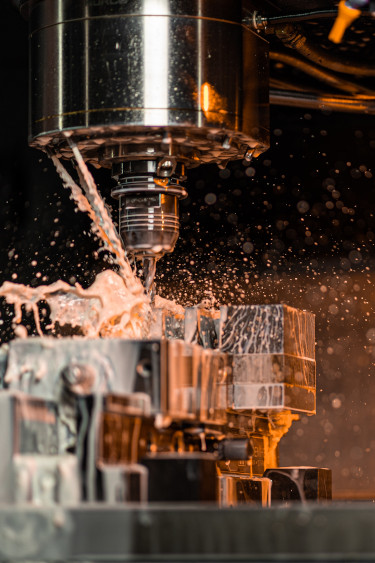

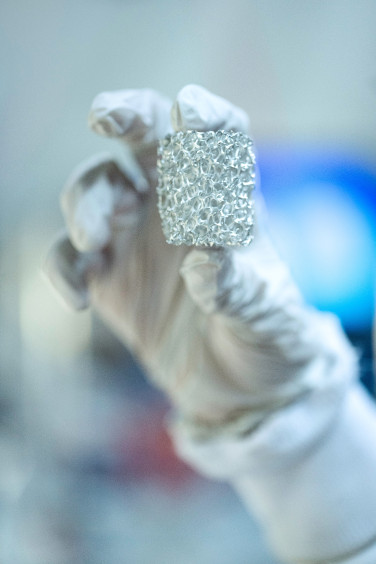

The scheme rewards you for both Product and/or Service Innovation, Process and/or Production Improvements and even any unsuccessful projects that you have attempted or completed.

We should be talking if you can answer “Yes” to at least one of the following questions:

- Do you innovate, create bespoke or new products, services, systems or processes for your clients?

- Do you routinely seek new and improved processes and ways of doing business for yourselves and your clients?

- Do you ever invest your time, technical knowledge and resources, tendering or quoting for work only to lose the project?

We educate you on how we build your claim, why we make certain assumptions, how we optimise a claim within the scheme rules, but most importantly, we take your personal and commercial risk appetite into consideration before you sign off on the claim figures we recommend.

If you are referred to us via your accountant; you will gain the added comfort and benefit of having their independent opinion, ongoing corporation tax advice and the protection of the valuable relationship you already have and trust. As a direct client, iCS will work closely with your own accountant and ensure that there is the opportunity to take their tax advice, now and with each future claim you make.

To obtain your R&D tax benefit, iCS will explain to HMRC on your behalf how projects:

- Have made an advancement in science and technology

- Had to overcome technical uncertainty

- Challenges could not be easily resolved by a professional in your field

While this may sound daunting, the iCS team of experts has developed a fast, refreshing and easy process, where we handle all of the heavy-lifting. In fact, the majority of clients invest somewhere between 45 minutes and 3 hours of management time across the whole process, providing an excellent return on the time invested by the business owners.

Structured and Simple Process

- Desktop Review: of your business and sector

- Short Exploratory Call: to confirm viability and ensure a valid claim will result

- No Form Filling: a sub three-hour meeting with appropriate decision makers and people to capture detailed project information for a Technical Report

- Financial Information: is supplied by your accountants

- Claim Filing: iCS or your accountant submits your claim to HMRC

- Settlement of Claim: HMRC typically settles your claim in 4-6 weeks after filing

- Return on Time Invested: for less than three hours spent with iCS, our average first claim is £54,000, which is typically received as a cash injection.

We support claims of all sizes

Please contact us today if you wish to explore how we can support you.